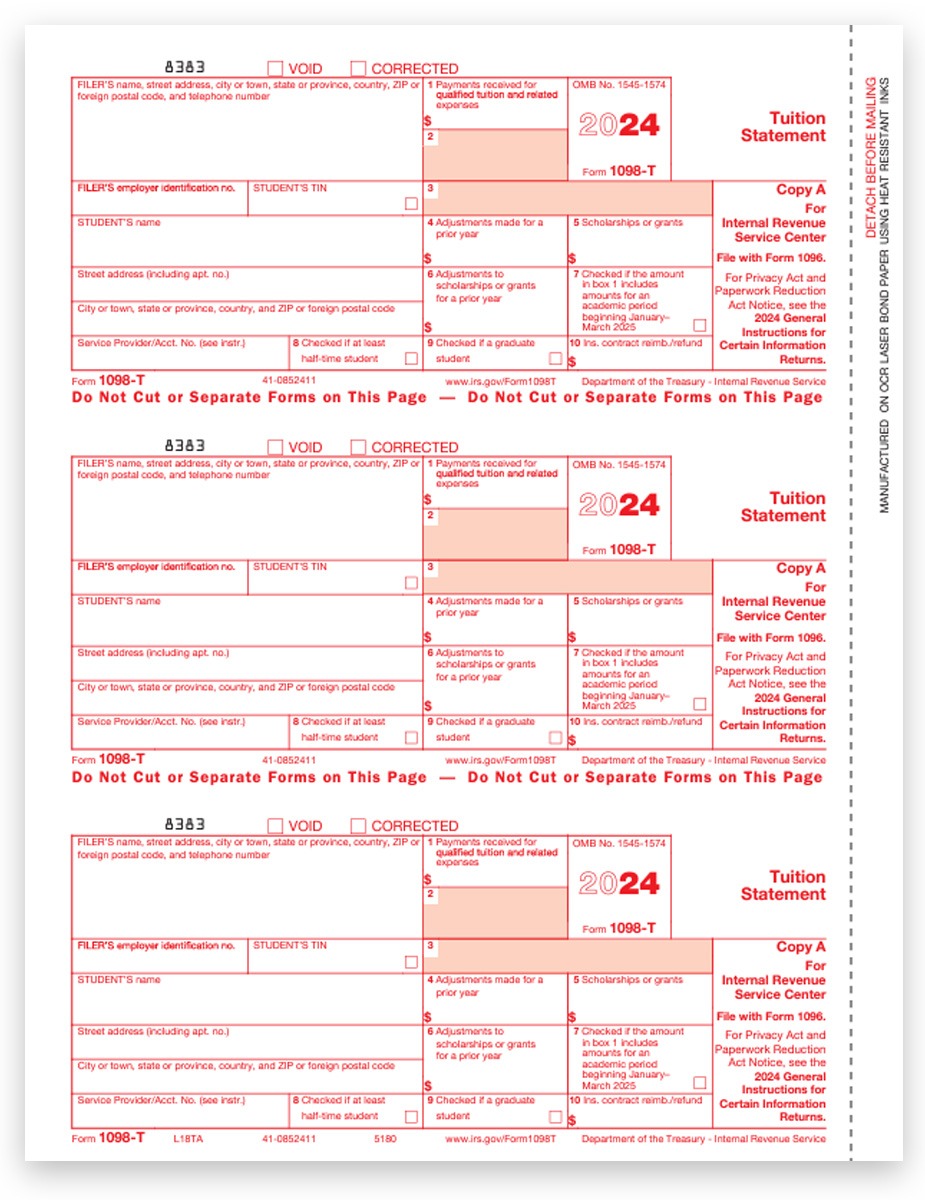

Free Printable 1098 T Form - Otherwise a form will be sent to them in the mail Whether a form is mailed electronically or on paper students will have the ability to go online to print their 1098 T form ECSI also provides a call center and online chat for questions about the 1098 T tax form The toll free number to contact them is 1 866 428 1098

IRS 1098 T Tax Form You may use this US tax form to help determine whether you or another taxpayer who claims you as a dependent may qualify for a federal education tax credit IRS Publication 970 explains two of these tax credits American Opportunity Credit and Lifetime Learning Credit and the tax treatment of scholarships

Free Printable 1098 T Form

Free Printable 1098 T Form

Instructions to Access 1098-T Tax Information Current Students . 1. Sign in to j. 2. Locate the Student Quick Links Card. Click on Student Self-Service. 3. Under the Student Accounts section, click on Tax Notification (1098-T) 4. Select the current tax year. The 1098-T will display and you can click the print button in the top right corner.

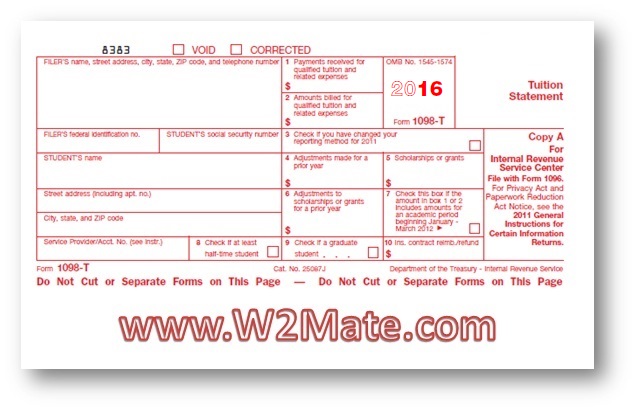

IRS Form 1098 T is a tax form used to report payments of qualified tuition and related expenses made in a tax year Educational institutions that receive the payments file the form with the IRS and send a copy to students who use the information it contains to file their tax returns PDF Updated November 08 2024

IRS 1098 T Tax Form dartmouth edu

All Form 1098 T Revisions About General Instructions for Certain Information Returns Internal Revenue Bulletin 1998 15 Announcement 98 27 PDF page 30 Internal Revenue Bulletin 2006 36 Notice 2006 72 page 363 About Publication 1179 General Rules and Specifications for Substitute Forms 1096 1098 1099 5498 W 2G and 1042 S

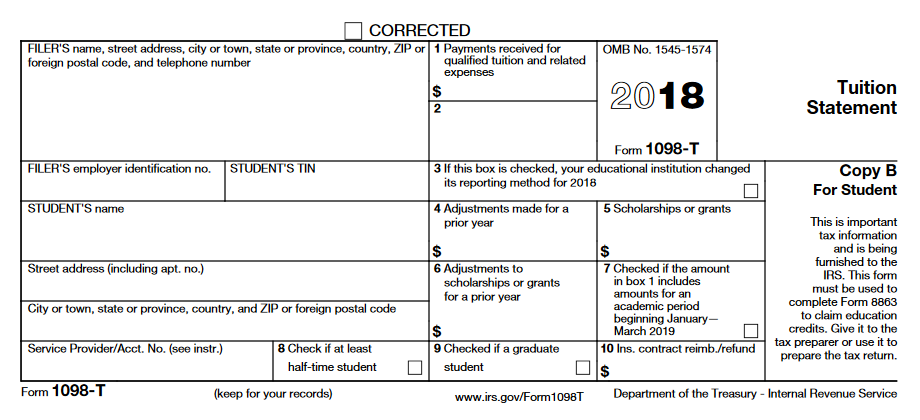

Printable 2018 1098 form: Fill out & sign online | DocHub

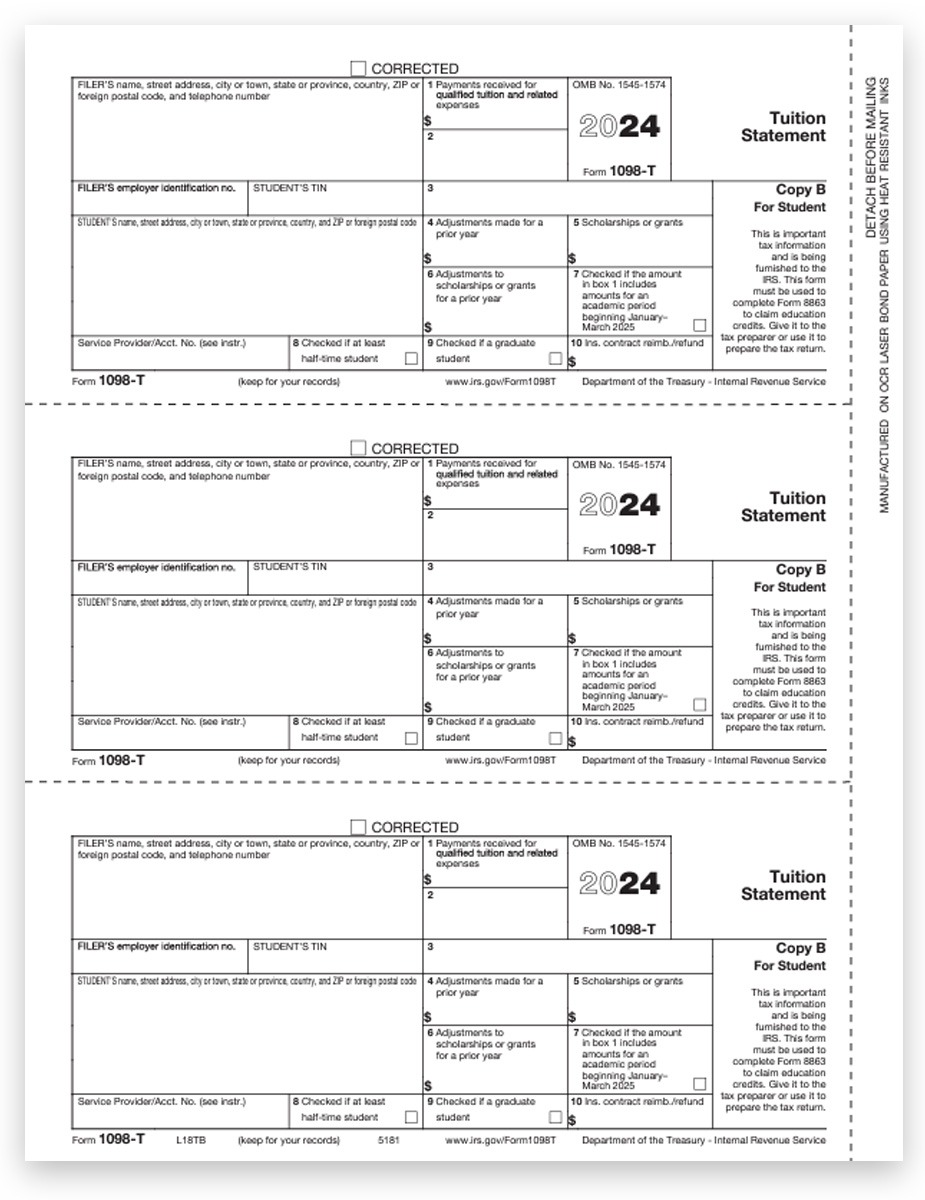

Download Fillable Irs Form 1098 t In Pdf The Latest Version Applicable For 2024 Fill Out The Tuition Statement Online And Print It Out For Free Irs Form 1098 t Is Often Used In U s Department Of The Treasury U s Department Of The Treasury Internal Revenue Service United States Federal Legal Forms Legal And United States Legal Forms

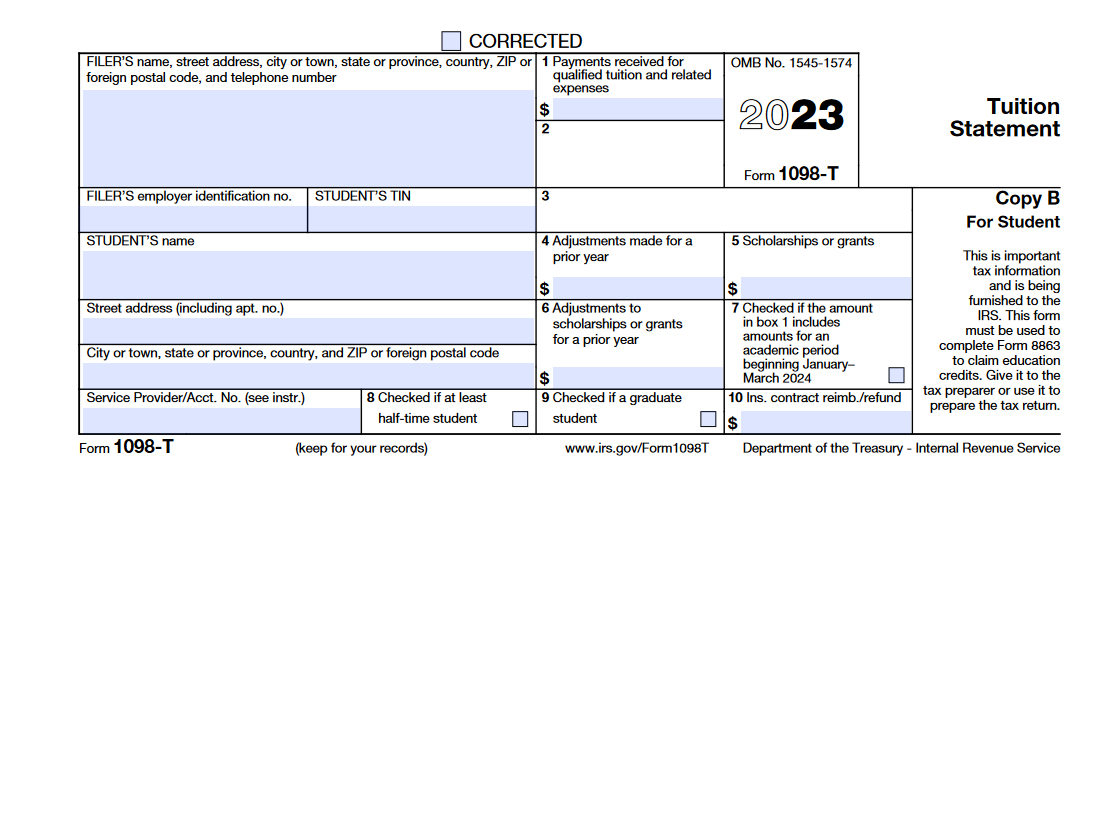

IRS Form 1098-T. Tuition Statement | Forms - Docs - 2023

1098T Form Tuition Expenses, Student Copy - DiscountTaxForms

Tuition Fees IRS Form 1098 T tompkinscortland edu

Get the IRS 1098 T tax form in PDF Obtain the blank printable 1098 T copy for 2023 with instructions Fill out the tuition statement online for free following our examples Here you can find all about the 1098 T student form free fillable template completed sample for download federal tax return

1098-T Software: 1098 T Printing Software | 1098 T Electronic Filing Software

Educational institutions must issue the 1098 T form by January 31 while lenders provide the 1098 E form by the same date These forms are essential for claiming education related tax credits and deductions The 1098 T form while not filed with the tax return contains information needed to complete IRS Form 8863 for education credits

[desc_10]

1098 T Tax Information Jackson State Community College

Unfortunately TurboTax does prompt you to upgrade when you file a 1098 T The website tells you that you cannot file a 1098 T without upgrading June 6 2019 8 18 AM

2024 Instructions for Forms 1098-E and 1098-T

1098T Form Tuition Expenses, Student Copy - DiscountTaxForms

Free Printable 1098 T Form

Educational institutions must issue the 1098 T form by January 31 while lenders provide the 1098 E form by the same date These forms are essential for claiming education related tax credits and deductions The 1098 T form while not filed with the tax return contains information needed to complete IRS Form 8863 for education credits

IRS 1098 T Tax Form You may use this US tax form to help determine whether you or another taxpayer who claims you as a dependent may qualify for a federal education tax credit IRS Publication 970 explains two of these tax credits American Opportunity Credit and Lifetime Learning Credit and the tax treatment of scholarships

1098-T Software to Create, Print & E-File IRS Form 1098-T

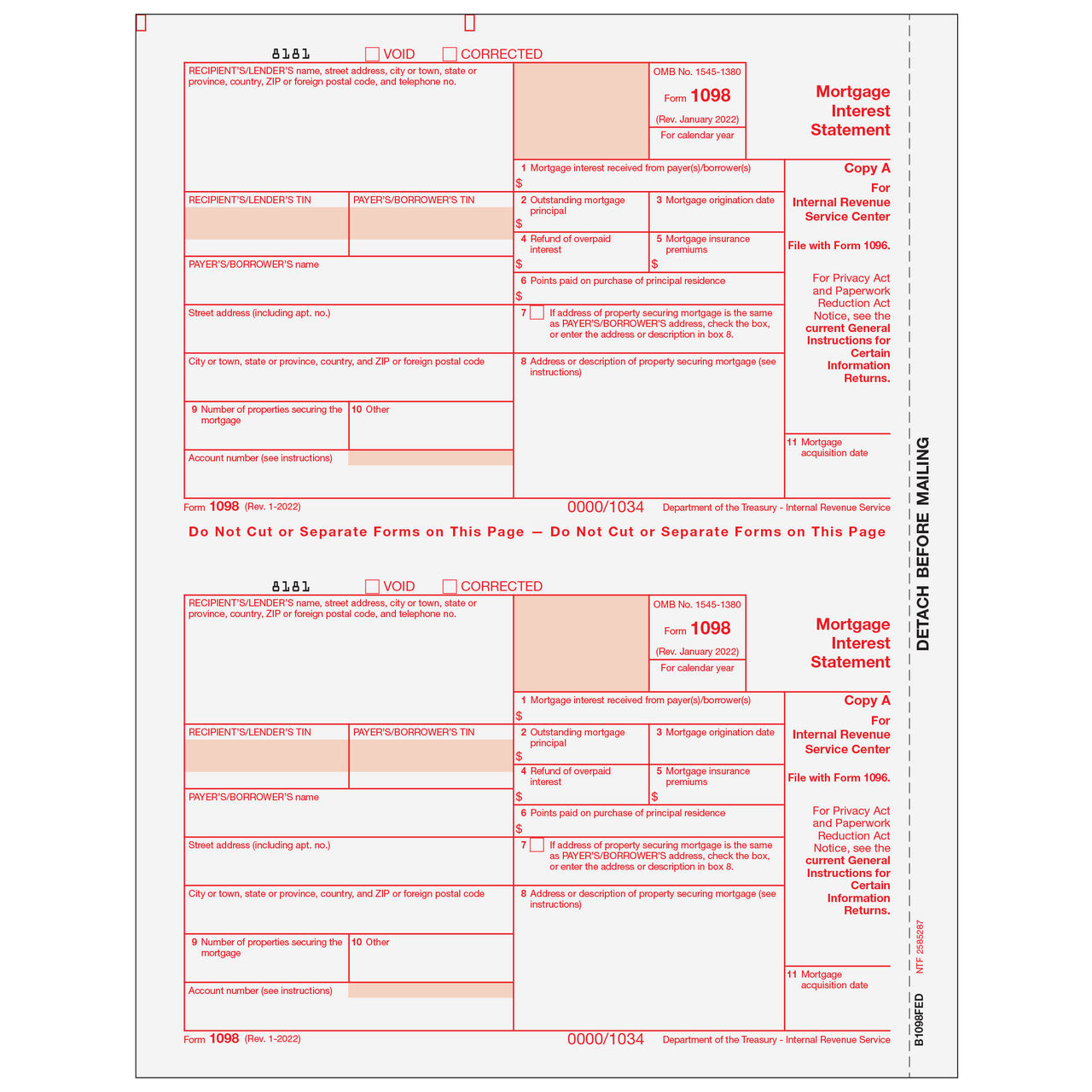

B1098FED05 - Form 1098 Mortgage Interest Statement - Copy A Federal - Greatland.com

Form 1098 (Mortgage Interest Statement) template | ONLYOFFICE

IRS Form 1098-T Tuition Statement for 2024 - PrintFriendly

How to Print and File Tax Form 1098, Mortgage Interest Statement